Business Sense is a no-fluff source of information that gets right to the heart of what small business owners need: essential tools and informational resources to help their businesses grow.

Business Sense

Next Level Tools for Entrepreneurs & Small Business Owners

Business Sense is a no-fluff source of information that gets right to the heart of what small business owners need: essential tools and informational resources to help their businesses grow. Written by our team of business coaches, this series shares their decades of experience in areas such as financials, operations, sales and marketing, human resources, leadership, and governance. Business Sense is designed to provide entrepreneurs and small business owners in various sectors, including agriculture, forestry, waste management, renewable energy, and environmental technology, with recommendations and practical advice to help their businesses not only survive but thrive.

Our business management coaching and training series, and Business Sense are designed to accelerate the growth of the enterprises we work with and expand the leadership capacity of the entrepreneurs who own and manage these businesses.

Let Us Help You and Your Business

The Vermont Sustainable Jobs Fund provides tailored business management coaching, entrepreneurial support, and training to position Vermont-based entrepreneurs and small business owners in our designated market sectors for growth and long-term success. We partner with state government, private sector businesses and nonprofit organizations to build a thriving economic, social and ecological future for Vermont.

Business Sen$e Resources

Click on the module and sub-module to expand each section, and to access the corresponding pdf resource.

Module 1: Financial Literacy

Building and running a business is no small feat, and understanding business finance shouldn’t stop you from achieving success. If you’re like many entrepreneurs, you have a general understanding of income vs. expenses. You know where to look on your financial statements to see how much cash you have in the bank or identify your net income. However, you may not know how to use the financial data you have to elevate your decision making, negotiations and leadership skills. In our Financial Literacy Series, we’ll provide some basic financial education for entrepreneurs and small business owners to help you understand how specific financial statements are like a dashboard for your business and how this critical data and disciplined processes and practices can keep you on track to meet your business goals.

1.1 The Importance of Financial Statements

Financial statements are critical as they accurately reflect the business’ performance and financial position. The knowledge the financial statements provide offers past and current performance benchmarks that inform decision-making. Financial statements help a business’ owner(s) and management to make minor adjustments and/or determine the business’ future direction to include expansion, financing, and even marketing by providing data indicating which aspects of company operations deliver the simplest return on investment. By publishing financial statements, management can also communicate with interested outside parties, like stakeholders, investors, journalists and industry analysts about its business accomplishments.

Financial statements are critical as they accurately reflect the business’ performance and financial position. The knowledge the financial statements provide offers past and current performance benchmarks that inform decision-making. Financial statements help a business’ owner(s) and management to make minor adjustments and/or determine the business’ future direction to include expansion, financing, and even marketing by providing data indicating which aspects of company operations deliver the simplest return on investment. By publishing financial statements, management can also communicate with interested outside parties, like stakeholders, investors, journalists and industry analysts about its business accomplishments.

1.2 The Importance of Cash Flow Statements

Cash flow can be an even more important measure of your business’s health and eventual success than your revenue or profit. Why? Because without cash, you can’t pay your bills or your employees. You can’t purchase inventory, you can’t pay rent, and you definitely can’t afford to invest in your business’s future. Most importantly, without a positive inflow of cash, you literally can’t sustain day-today business operations. You need money in the bank to make purchases that keep your business afloat and help you avoid unnecessary debt. Said simply, when you have positive cash flow, you’re making enough money to cover your bills and even reinvest in your business, expanding operations and hiring new employees.

Cash flow can be an even more important measure of your business’s health and eventual success than your revenue or profit. Why? Because without cash, you can’t pay your bills or your employees. You can’t purchase inventory, you can’t pay rent, and you definitely can’t afford to invest in your business’s future. Most importantly, without a positive inflow of cash, you literally can’t sustain day-today business operations. You need money in the bank to make purchases that keep your business afloat and help you avoid unnecessary debt. Said simply, when you have positive cash flow, you’re making enough money to cover your bills and even reinvest in your business, expanding operations and hiring new employees.

1.3 The Purpose of Business Controls

Business controls are the intelligent processes, procedures, and safeguards that protect your company from uninformed or inappropriate decisions or actions by any team member. As you grow your business, you want your management team as well as your employees to have both the knowledge and the authority to complete tasks without running everything past you. Business controls enable employees to exercise their judgment and use their discretion if you have empowered them with the ground rules, feedback, and systems they need to do their best work. As a specialized subset of your business, business controls and SOPs facilitate and support your employees’ performance, ensure product quality and consistency while eliminating inefficiencies and waste, and reinforce a culture of continuous improvement and growth across your organization.

Business controls are the intelligent processes, procedures, and safeguards that protect your company from uninformed or inappropriate decisions or actions by any team member. As you grow your business, you want your management team as well as your employees to have both the knowledge and the authority to complete tasks without running everything past you. Business controls enable employees to exercise their judgment and use their discretion if you have empowered them with the ground rules, feedback, and systems they need to do their best work. As a specialized subset of your business, business controls and SOPs facilitate and support your employees’ performance, ensure product quality and consistency while eliminating inefficiencies and waste, and reinforce a culture of continuous improvement and growth across your organization.

1.4 The Purpose of Internal Controls

A business establishes internal controls, or financial procedures and processes, as a measure against wrongdoing and as a tool to promote accountability, protect the company’s interests and ensure the integrity of financial data. Strong internal controls can improve operational effectiveness and efficiencies while also ensuring accurate financial reporting during internal or external audits. It’s important to remember that internal controls are unique to every business and designed according to the company’s size and structure. Internal controls not only address risks to the company but also reduce incurrences of unnecessary cost or effort that wastes resources of any type.

A business establishes internal controls, or financial procedures and processes, as a measure against wrongdoing and as a tool to promote accountability, protect the company’s interests and ensure the integrity of financial data. Strong internal controls can improve operational effectiveness and efficiencies while also ensuring accurate financial reporting during internal or external audits. It’s important to remember that internal controls are unique to every business and designed according to the company’s size and structure. Internal controls not only address risks to the company but also reduce incurrences of unnecessary cost or effort that wastes resources of any type.

1.5 Functional Detail on Different Levels of Enterprise Accounting

A strong finance team that consists of a CFO, controller, accountant and bookkeeper can grow your business in ways you’ve never imagined. Of course, the actual number of employees on the finance team is dependent on the needs and profitability of your business. While you may know the direction you want your business to go in the future, a finance team has the expertise to break that long-term vision down into practical steps with a realistic timeline, and to assist you in developing the systems critical for internal controls, whether inventory, purchasing or process quality. The most important approach to addressing your business’ financial needs is to have self-awareness and transparency to determine if you’re investing appropriately in this crucial part of your business.

A strong finance team that consists of a CFO, controller, accountant and bookkeeper can grow your business in ways you’ve never imagined. Of course, the actual number of employees on the finance team is dependent on the needs and profitability of your business. While you may know the direction you want your business to go in the future, a finance team has the expertise to break that long-term vision down into practical steps with a realistic timeline, and to assist you in developing the systems critical for internal controls, whether inventory, purchasing or process quality. The most important approach to addressing your business’ financial needs is to have self-awareness and transparency to determine if you’re investing appropriately in this crucial part of your business.

Module 2: Business Operations

You may have the best product or service, but if you are unable to deliver, you won’t be successful. If you aim to grow, your operational capabilities need to be on the same pace as your sales growth. At best, operational issues are bumps in the road. At worst, they can derail all your prior efforts, erode customer good will and negatively impact brand reputation. When you implement a well-though tout business structure, you are able to document all the business processes and, at the same time, specify all the roles and responsibilities (or competencies) in your company. This is particularly important to optimizing employee performance when employees are working in multiple locations and/or in hybrid work environments. With the right business structure for your business you can easily foster a more engaged workforce without stifling innovation and position your business to compete successfully in this highly competitive world.

2.1 Systems and Operations – People, Process and Tools (P-P-T) Framework

In all types of business, large and small, the People, Process, and Tools (P-P-T) framework is used to improve the business’ position in the face of market competition and to remain relevant over time. Everything, from leadership to digital transformation, organizational talent, and management practices, needs to be combined for effective development. The concept of PPT or the Golden Triangle works with existing practices to ensure stronger and better business results. People and processes, along with technology, are the key elements for the overall improvement and sustainability of your business. As you build the systems focusing on these three areas, you can expect to see better outcomes in every department. Your aim should be to build agile work forces that are flexible, adaptable, and responsive to the dynamics of your industry and the realities of your environment. Businesses today need an inclusive approach to satisfy their customer’s requirements.

In all types of business, large and small, the People, Process, and Tools (P-P-T) framework is used to improve the business’ position in the face of market competition and to remain relevant over time. Everything, from leadership to digital transformation, organizational talent, and management practices, needs to be combined for effective development. The concept of PPT or the Golden Triangle works with existing practices to ensure stronger and better business results. People and processes, along with technology, are the key elements for the overall improvement and sustainability of your business. As you build the systems focusing on these three areas, you can expect to see better outcomes in every department. Your aim should be to build agile work forces that are flexible, adaptable, and responsive to the dynamics of your industry and the realities of your environment. Businesses today need an inclusive approach to satisfy their customer’s requirements.

2.2 Metrics and KPIs (Key Performance Indicators)

KPIs and metrics enable a business owner to keep business objectives at the forefront in decision-making and to more fully understand the business’ performance, track results and make course corrections as necessary to ensure long-lasting impact and success. KPIs encourage a culture of accountability and serve as the foundation for employee performance evaluations. A KPI may reveal that a perceived “poor performer” may have some favorable stats and deliver good results. And, poorly performing employees can’t dispute when data-driven and objectively based KPI stats demonstrate the absence of results. As importantly, if the majority of your employees are having difficulty achieving the KPIs that have been set, it may be time to reevaluate your business’ goals to understand why exactly those targets are not being hit. KPIs thus foster an environment of continuous learning, enabling you to set realistic goals for your business growth and how you want to measure its success.

KPIs and metrics enable a business owner to keep business objectives at the forefront in decision-making and to more fully understand the business’ performance, track results and make course corrections as necessary to ensure long-lasting impact and success. KPIs encourage a culture of accountability and serve as the foundation for employee performance evaluations. A KPI may reveal that a perceived “poor performer” may have some favorable stats and deliver good results. And, poorly performing employees can’t dispute when data-driven and objectively based KPI stats demonstrate the absence of results. As importantly, if the majority of your employees are having difficulty achieving the KPIs that have been set, it may be time to reevaluate your business’ goals to understand why exactly those targets are not being hit. KPIs thus foster an environment of continuous learning, enabling you to set realistic goals for your business growth and how you want to measure its success.

2.3 Operational Management – RASCI Who Does What?

RASCI is a chart (i.e. model or framework) that is used to help identify all the roles and responsibilities of each stakeholder on a project. A RASCI Chart clearly defines who is working on a specific subtask of a project. As an organization grows, or new projects are undertaken by a team of people, the work is often divided. Using a RASCI approach clarifies the individual role of team members on a project and enables the tasks to be done efficiently. RASCI Charts provide clarity around “who does what”, “who can help with this task”, and “who’s responsible for this task” on a wide range of business functions.

RASCI is a chart (i.e. model or framework) that is used to help identify all the roles and responsibilities of each stakeholder on a project. A RASCI Chart clearly defines who is working on a specific subtask of a project. As an organization grows, or new projects are undertaken by a team of people, the work is often divided. Using a RASCI approach clarifies the individual role of team members on a project and enables the tasks to be done efficiently. RASCI Charts provide clarity around “who does what”, “who can help with this task”, and “who’s responsible for this task” on a wide range of business functions.

2.4 The Value of Customer Relationship Management (CRM)

Customer relationships are essential to the success of any business. However, keeping track of each customer’s information can prove cumbersome for even the most organized companies and downright chaotic for the rest. If you’re searching for a customer relationship

Customer relationships are essential to the success of any business. However, keeping track of each customer’s information can prove cumbersome for even the most organized companies and downright chaotic for the rest. If you’re searching for a customer relationship

management (CRM) system, you’ve probably hit the point where spreadsheets of customer data – phone numbers, email addresses, and previous correspondence – have become unorganized and inefficient.

A customer relationship management (CRM) system collects, organizes, and manages all of your customer-related information so you can track the buyer’s journey for every individual you interact with, streamline communication, enhance the customer experience, and improve data management.

Salespeople report that the biggest benefits of a CRM are keeping track of leads, using the CRM as a centralized database, improving customer retention, and helping to share data across their organization. A CRM system can also help align your sales, marketing and service teams to streamline the buyer’s journey.

Module 3: Business Leadership and Governance

Leadership and governance play a crucial role in the success of small businesses. Effective leadership can inspire employees, foster innovation, and drive growth. Governance ensures that the business operates ethically, transparently, and in compliance with legal and regulatory requirements. Corporate governance essentially involves balancing the interests of a company’s many stakeholders, which can include owners, senior management, customers, suppliers, lenders, the government, and the community.

3.1 Creating a Board of Advisors

When creating an Advisory Board, two items are of utmost importance.

When creating an Advisory Board, two items are of utmost importance.

- An advisory board is not a quick fix for problems. Advisory boards work best over a period of time where you create a long term strategy/plan and work to achieve short term goals against the long term strategy/plan.

- As the business owner, you must be open to hearing opinions and advice that may be contrary to the way you have always thought or acted.

For both of these reasons, you should choose advisory board members who you respect, have a range of experience and knowledge to complement your own, who ask good questions, and who will tell you the truth. Remember that your advisory board is not a business coach nor do they serve as consultants. Rather your advisory board will help you think of creative ways to optimize your business processes, people, vendors, channels, sales and marketing and identify growth in areas where none were previously seen. With their expertise your goal should be to create or refine a long-term plan that holds you and your team accountable for your stated business goals and Key Performance Indicators (KPIs) or other metrics.

3.2 Advisory Board Charter

3.3 Business Advisory Board Agreement

3.4 Succession Planning for Business Evolution

Succession planning is a crucial aspect of running a small business. It involves developing a strategy and identifying and developing the talent to fulfill the critical roles that ensure the continuity of your business when you decide to exit, or the stability of your business in times of crisis. A well thought out succession plan can provide peace of mind and help protect the legacy of the business that you’ve built. Other benefits of succession planning include identifying your most promising future leaders, creating a structure for training and professional development, boosting morale and reducing business exposure or risk.

Succession planning is a crucial aspect of running a small business. It involves developing a strategy and identifying and developing the talent to fulfill the critical roles that ensure the continuity of your business when you decide to exit, or the stability of your business in times of crisis. A well thought out succession plan can provide peace of mind and help protect the legacy of the business that you’ve built. Other benefits of succession planning include identifying your most promising future leaders, creating a structure for training and professional development, boosting morale and reducing business exposure or risk.

3.5 Strategic Planning

It’s been said that if you don’t know where your business is going, any road will get you there. You may not be happy with where ‘there’ turns out to be though. Strategic planning is the process by which an organization identifies not

It’s been said that if you don’t know where your business is going, any road will get you there. You may not be happy with where ‘there’ turns out to be though. Strategic planning is the process by which an organization identifies not

only where it’s going, but also how it’s going to get there. Strategic planning can be complex, challenging, and even messy, but you can always return to these basics for insight into your own strategic planning process, however you decide to implement it.

3.6 The Importance of Recognition to Workplace Culture

With so much change and uncertainty affecting workplaces, it can be easy to forget that employees are at the center of any organization’s success. What employees feel – about the companies they work for, their leaders, their teams, and themselves – ultimately provides the fuel for high performance through increased productivity, safer workplaces and decreased absenteeism.

With so much change and uncertainty affecting workplaces, it can be easy to forget that employees are at the center of any organization’s success. What employees feel – about the companies they work for, their leaders, their teams, and themselves – ultimately provides the fuel for high performance through increased productivity, safer workplaces and decreased absenteeism.

When employees feel valued for who they are and what they do, they act differently, in ways that positively impact their teams and organizations. Every business owner, leader and manager plays a vital role in workplace culture.

Module 4: Human Resources

Effective Human Resources (HR) is essential to the success of a business, regardless of its size. Your human resource practices and policies should align with your company’s values and positively impact your company culture, as well as your bottom line. From improving company morale and developing methods to ensure high performance standards to resolving conflicts among employees and ensuring a company stays within its compensation budget, there are many reasons why HR is important for business success.

Your employees are your most valuable resource—holistically caring for their employment experience, and taking care of their well-being, must be a top priority.

4.1 Staffing Your Business

Attracting, hiring, and retaining the right people is key to any organization’s success. Having employees with the right skills, abilities, interests, values, and temperament helps ensure that quality services and products are created and delivered, and makes a positive contribution to the company culture. Done well, a hiring process allows business owners and their leaders (supervisors, shift leads managers) to focus their time on activities that help strengthen and grow the business, and support and develop their employees, instead of addressing problems related to behavior, performance, safety, or quality.

Attracting, hiring, and retaining the right people is key to any organization’s success. Having employees with the right skills, abilities, interests, values, and temperament helps ensure that quality services and products are created and delivered, and makes a positive contribution to the company culture. Done well, a hiring process allows business owners and their leaders (supervisors, shift leads managers) to focus their time on activities that help strengthen and grow the business, and support and develop their employees, instead of addressing problems related to behavior, performance, safety, or quality.

4.2 Attracting the Right Candidates

Quality hiring practices take time and money to develop and put in place, and skilled, caring supervisors to consistently follow and help improve. Key activities include preparing job descriptions, creating and managing a process for sourcing, vetting, and selecting candidates through interviews, reference checks, and hiring decisions, and designing and implementing a new employee onboarding process, all in compliance with relevant laws and aligned with your culture. This document outlines strategies, tools, and resources aimed at getting the right people into your organization, and in the right roles.

Quality hiring practices take time and money to develop and put in place, and skilled, caring supervisors to consistently follow and help improve. Key activities include preparing job descriptions, creating and managing a process for sourcing, vetting, and selecting candidates through interviews, reference checks, and hiring decisions, and designing and implementing a new employee onboarding process, all in compliance with relevant laws and aligned with your culture. This document outlines strategies, tools, and resources aimed at getting the right people into your organization, and in the right roles.

4.3 Effective Hiring Processes

Hiring employees takes time and care to ensure you hire people with the knowledge, skills, and experience needed to perform key functions in your business. While the hiring process for entry-level positions may be fairly quick and simple compared to executive-level roles, both can benefit from a structured process.

Hiring employees takes time and care to ensure you hire people with the knowledge, skills, and experience needed to perform key functions in your business. While the hiring process for entry-level positions may be fairly quick and simple compared to executive-level roles, both can benefit from a structured process.

4.4 Compensation and Benefits Management

As a business owner, you, eventually with the help of an HR team, are responsible for determining your total compensation philosophy, strategy, practices, and structure, including base pay and any additional compensation. When designing a total compensation structure, you need to first be aware of any statutory requirements regarding pay related considerations, such as federal and Vermont minimum wage and overtime, the federal Equal Pay Act, worker’s compensation insurance, and Vermont’s Fair Employment Practices Act. There are also some mandated time-off benefits, such as Vermont’s paid sick leave law and Parental and Family Leave Act. Even though the latter doesn’t require employers to provide paid leave, it is important to consider these benefits as part of the time off an employee may need to take.

As a business owner, you, eventually with the help of an HR team, are responsible for determining your total compensation philosophy, strategy, practices, and structure, including base pay and any additional compensation. When designing a total compensation structure, you need to first be aware of any statutory requirements regarding pay related considerations, such as federal and Vermont minimum wage and overtime, the federal Equal Pay Act, worker’s compensation insurance, and Vermont’s Fair Employment Practices Act. There are also some mandated time-off benefits, such as Vermont’s paid sick leave law and Parental and Family Leave Act. Even though the latter doesn’t require employers to provide paid leave, it is important to consider these benefits as part of the time off an employee may need to take.

4.5 Employment Laws and Employee Policies

Complying with applicable employment laws is important for several reasons, not the least of which is that failure to do so can lead to penalties and other fines, and damages such as back wages that could be due if an employer is not in compliance with the overtime provisions of federal and state wage and hour laws. Another reason is to ensure that you have the proper policies and practices in place to protect and benefit both yourself and employees. Lastly, complying with employment laws can help support risk management, safety, and workplace culture goals. By notifying employees of their rights and responsibilities, you are not only ensuring compliance, but you are building transparency and opening lines of communications for issues that may surface.

Complying with applicable employment laws is important for several reasons, not the least of which is that failure to do so can lead to penalties and other fines, and damages such as back wages that could be due if an employer is not in compliance with the overtime provisions of federal and state wage and hour laws. Another reason is to ensure that you have the proper policies and practices in place to protect and benefit both yourself and employees. Lastly, complying with employment laws can help support risk management, safety, and workplace culture goals. By notifying employees of their rights and responsibilities, you are not only ensuring compliance, but you are building transparency and opening lines of communications for issues that may surface.

4.6 Leading at the Speed of Effective Communications

Effective communication is the single most powerful tool a leader has to move a team into constructive action. Whether face-to-face, via email, through video conferencing or in a group meeting, one of the most difficult tasks a leader must perform is providing constructive feedback that allows team members to make difficult adjustments, improve their ‘game’ and succeed at their job. When communication is valued as a core competency, organizations improve in all areas of performance excellence.

Effective communication is the single most powerful tool a leader has to move a team into constructive action. Whether face-to-face, via email, through video conferencing or in a group meeting, one of the most difficult tasks a leader must perform is providing constructive feedback that allows team members to make difficult adjustments, improve their ‘game’ and succeed at their job. When communication is valued as a core competency, organizations improve in all areas of performance excellence.

Module 5: Marketing

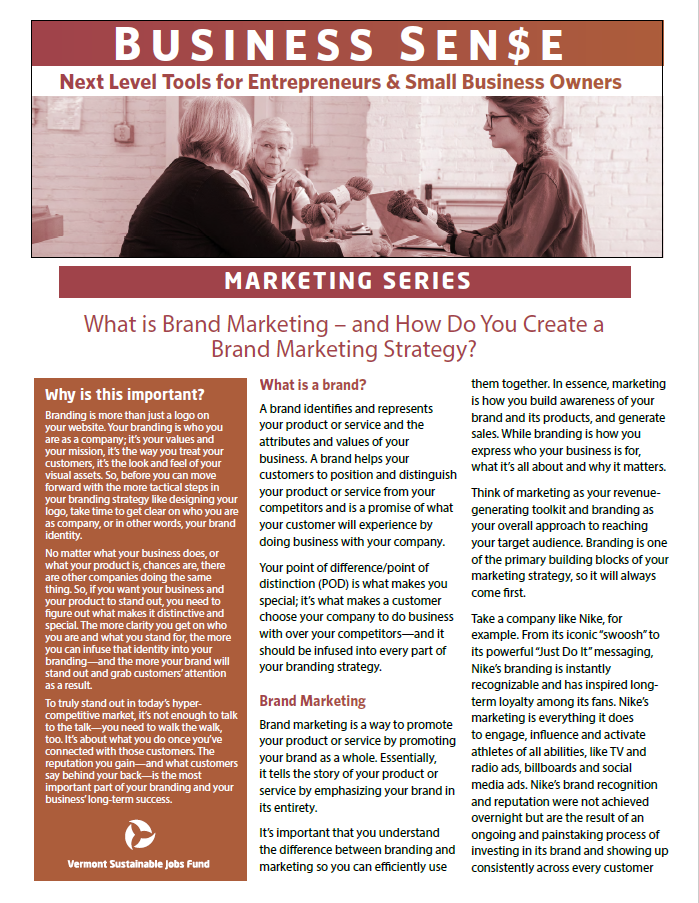

Branding is more than just a logo on your website. Your branding is who you are as a company; it’s your values and your mission, it’s the way you treat your customers, it’s the look and feel of your visual assets. So, before you can move forward with the more tactical steps in your branding strategy like designing your logo, take time to get clear on who you are as company, or in other words, your brand identity.

No matter what your business does, or what your product is, chances are, there are other companies doing the same thing. So, if you want your business and your product to stand out, you need to figure out what makes it distinctive and special. The more clarity you get on who you are and what you stand for, the more you can infuse that identity into your branding—and the more your brand will stand out and grab customers’ attention as a result.

5.1 The Power of Branding–Your Brand’s Positioning Statement

The purpose of a well-crafted brand positioning statement is to convey a brand’s value proposition to its’ target customers, and to increase the brand’s perceived value and trust. It also frames the brand’s identity, goals, and distinguishing features within the context of the buyer’s experience. Unlike your mission statement, your brand positioning statement is not public-facing. Rather it’s an internal positioning statement intended to summarize the value that your brand, products, and services bring to your current and prospective customers.

The purpose of a well-crafted brand positioning statement is to convey a brand’s value proposition to its’ target customers, and to increase the brand’s perceived value and trust. It also frames the brand’s identity, goals, and distinguishing features within the context of the buyer’s experience. Unlike your mission statement, your brand positioning statement is not public-facing. Rather it’s an internal positioning statement intended to summarize the value that your brand, products, and services bring to your current and prospective customers.

5.2 Knowing Your Customer is Knowing Your Market

The first rule in sales is to know your customers. Knowing who your customers are and understanding their needs, expectations, lifestyle and habits, is key to increasing revenue and profits and building brand loyalty. When you truly know your customers, opportunities for connection are easier to find and aligning sales and marketing tactics with actual customer needs is more efficient and less costly.

The first rule in sales is to know your customers. Knowing who your customers are and understanding their needs, expectations, lifestyle and habits, is key to increasing revenue and profits and building brand loyalty. When you truly know your customers, opportunities for connection are easier to find and aligning sales and marketing tactics with actual customer needs is more efficient and less costly.

5.3 How to Create a Digital Marketing Plan

A digital marketing plan is a document in which you strategically map out your digital marketing objectives, as well as the actions you’ll take to achieve those objectives. Among other things, it can include business goals, digital strategies, and competitive landscape analysis as well as timelines, budgets, digital channels, and more.

A digital marketing plan is a document in which you strategically map out your digital marketing objectives, as well as the actions you’ll take to achieve those objectives. Among other things, it can include business goals, digital strategies, and competitive landscape analysis as well as timelines, budgets, digital channels, and more.

Without a well-defined plan in place, your digital marketing efforts will be inefficient and ineffective – and it’s likely you’ll waste money and see diminished returns.

As digital marketing continues to grow and take over market share from traditional marketing, many small business founders and marketing managers are asking how much they should be spending on digital marketing.

5.4 What is a Creative Brief?

A creative brief is a short 1 to 2 page document outlining the strategy for a creative project (i.e., logo, product

A creative brief is a short 1 to 2 page document outlining the strategy for a creative project (i.e., logo, product

packaging, print ad, social media campaign, etc.). A creative brief is a map that guides a design or advertising

agency, or a company’s internal creative team on how to best attain the goals of the initiative or campaign. At a design or advertising agency, the creative brief is usually created by the account manager in close consultation with the client, who can be the business owner or a delegate of the owner most often responsible for the marketing and sales activities of the business.

5.5 Brand Ambassador Program

A brand ambassador program is a strategy that lets you formally recruit your biggest advocates – people who love your brand and are already enthusiastically engaged with it – to be your long-term promotional partner. Usually, it involves mobilizing these evangelical ambassadors to accomplish a specific goal, such as increasing sales, driving conversions, improving social selling/engagement or building brand awareness and trust.

A brand ambassador program is a strategy that lets you formally recruit your biggest advocates – people who love your brand and are already enthusiastically engaged with it – to be your long-term promotional partner. Usually, it involves mobilizing these evangelical ambassadors to accomplish a specific goal, such as increasing sales, driving conversions, improving social selling/engagement or building brand awareness and trust.

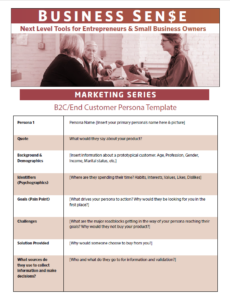

5.6 B2C/End Customer Persona Template

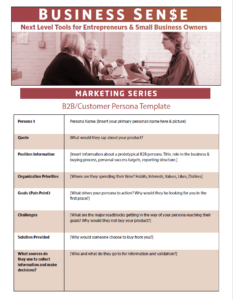

5.7 B2B/End Customer Persona Template

Module 6: Sales

As a small business owner, if you are not concerned with maximizing sales, your company may not be as profitable as you hope it would be. Without the sale of products or services, a business becomes a hobby or a charitable organization. Your business’ sales should not be the sole responsibility of your sales force. Every employee should understand how sales happen and what they can do to favorably impact sales; if a person isn’t selling, they may be missing an opportunity to help the company grow and thrive.

Sales come from a variety of sources, and most business leaders have specific strategies for each marketing channel and customer type. When a business owner can efficiently scale sales up without significantly increasing the costs per sale, then the business grows not only in size, but also in margin and profitability. For example, an online sales funnel such as your website could sell products without a sales representative. However, the efficiency of fulfilling the order and the quality of the customer experience is what helps seal the deal. This is important, because sales generate revenue that pays for the virtual storefront, inventory and any marketing expenses that bring prospective customers to the storefront.

6.1 Revenue Forecasting

There are a number of benefits to forecasting your revenue. Just like with strategic planning, financial modeling, business operations and organizational development, revenue forecasting is all about managing your cash flow and preparing your company for whatever the future holds so that you’re not caught by surprise and can make the best decisions to grow your business. For greater clarity, revenue is the money a business earns from the sale of its products and services. Cash flow is the net amount of cash being transferred into and out of a company. Revenue provides a measure of the effectiveness of a company’s sales and marketing, whereas cash flow is more of a liquidity indicator.

There are a number of benefits to forecasting your revenue. Just like with strategic planning, financial modeling, business operations and organizational development, revenue forecasting is all about managing your cash flow and preparing your company for whatever the future holds so that you’re not caught by surprise and can make the best decisions to grow your business. For greater clarity, revenue is the money a business earns from the sale of its products and services. Cash flow is the net amount of cash being transferred into and out of a company. Revenue provides a measure of the effectiveness of a company’s sales and marketing, whereas cash flow is more of a liquidity indicator.

There are a few key reasons why you should forecast revenue including building a realistic budget for your business when it’s likely that your revenue varies each month. Your future revenue can fluctuate depending on how much you sell, and the overall market conditions which can make it difficult to budget for operating expenses like marketing and promotion, or new expenses like hiring employees.

Revenue forecasting helps bridge that gap, particularly for operating expenses. Your forecast gives you an estimate of how much revenue you’ll generate over the next few months, or the entire year. This will allow you to know how much you can budget for sales promotions, new hires, software, and other expenses that change over time.

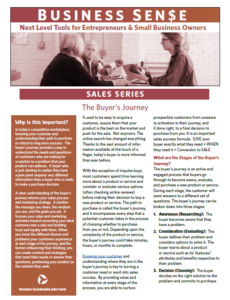

6.2 The Buyer's Journey

In today’s competitive marketplace, knowing your customer and understanding their path to purchase is critical to long-term success. The buyer’s journey provides a way to understand the needs and questions of customers who are looking for a solution to a problem that your product can address. A buyer who is just starting to realize they have a pain point requires very different information than a buyer who is ready to make a purchase decision.

In today’s competitive marketplace, knowing your customer and understanding their path to purchase is critical to long-term success. The buyer’s journey provides a way to understand the needs and questions of customers who are looking for a solution to a problem that your product can address. A buyer who is just starting to realize they have a pain point requires very different information than a buyer who is ready to make a purchase decision.

A clear understanding of the buyer’s journey informs your sales process and marketing strategy. It clarifies the message you share, the medium you use, and the goals you set. It focuses your sales and marketing activities toward converting your ideal customer into a sale and building trust and loyalty with them. When you know the different desires and problems your customers experience at each stage of the journey, and the factors influencing their thinking, you can create content and strategies that meet their needs or answer their questions, positioning your product as the solution they seek.

We’ve translated Module 1: Financial Literacy into other languages for business owners fluent in other languages:

Thanks to the generous support of the Vermont Agency of Agriculture, Food and Markets, the Vermont Farm and Forest Viability Program (a program of the Vermont Housing and Conservation Board), and the SBA Community Navigator Pilot Program, we have been able to publish this Business Sense series as another way to help companies stay and grow in Vermont.

Vermont Sustainable Jobs Fund Ellen Kahler recently caught up with VtSBDC to talk about the Community Navigator Pilot Program, VSJF’s Business Coaching Program and the Business Sense Training Series.